Introduction:

In the fast-paced digital age, managing finances has become an integral aspect of everyday life. PayNuVerActivate steps into the spotlight as a catalyst for financial empowerment, offering individuals the tools they need to manage their money smarter. This article delves into the features, benefits, and steps to activate the 16-digit card number, showcasing how PayNuVerActivate is revolutionizing the way we handle our finances.

1. The Rise of Smart Money Management:

The need for smarter financial solutions is more significant than ever, and PayNuVerActivate is at the forefront of this revolution. Explore the overarching trends in smart money management and how PayNuVerActivate aligns with the evolving needs of today’s consumers.

2. Key Features of PayNuVerActivate:

Uncover the standout features that make PayNuVerActivate a game-changer in the financial landscape. From intuitive budgeting tools and real-time transaction tracking to personalized insights, delve into how PayNuVerActivate empowers users to take control of their financial destinies.

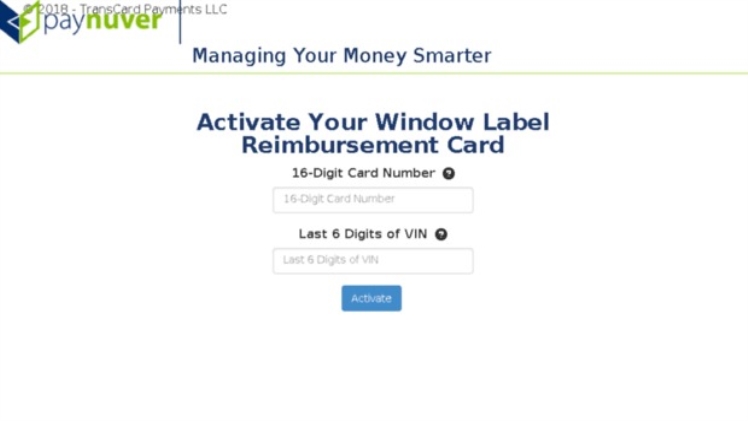

3. Understanding the 16-Digit Card Number:

The activation process begins with the 16-digit card number. Demystify the significance of this unique identifier, providing clarity on its role in the PayNuVerActivate ecosystem. Whether it’s a debit card, credit card, or a prepaid card, the 16-digit number is the key to unlocking a world of financial possibilities.

4. How to Activate Your PayNuVerActivate Card: Step by Step Guide:

Navigating the activation process is crucial for users to unlock the full potential of PayNuVerActivate. Provide a detailed step-by-step guide on how users can activate their cards using the 16-digit number, ensuring a seamless and secure experience.

5. Personalized Financial Insights:

One of the standout features of PayNuVerActivate is its ability to provide personalized financial insights. Explore how the platform utilizes data analytics to offer users tailored advice, budgeting recommendations, and strategic financial planning tips based on their spending patterns.

6. Real-Time Transaction Tracking:

In the age of immediacy, PayNuVerActivate excels in offering real-time transaction tracking. Delve into how users can stay informed about their financial activities as they happen, enabling better decision-making and financial awareness.

7. Security Measures and User Protections:

Security is paramount in the financial realm. Highlight the robust security measures employed by PayNuVerActivate to safeguard user data, transactions, and overall financial information. From encryption technologies to fraud detection, assure users of the platform’s commitment to their financial safety.

8. The Future of Smart Financial Management:

Conclude the article by peering into the future of smart financial management. Consider potential updates, innovations, and expansions that PayNuVerActivate might bring to the table, positioning itself as a long-term ally in users’ financial journeys.

Conclusion: PayNuVerActivate – Redefining Financial Freedom:

In conclusion, PayNuVerActivate emerges as a beacon of financial empowerment, reshaping the way individuals manage their money. With intuitive features, personalized insights, and a commitment to security, PayNuVerActivate stands as a key player in the quest for smarter, more informed financial decisions.